When purchasing any residential property, most will need to consider whether they have to pay Stamp Duty Land Tax on their new home.

Read on to learn what Stamp Duty is, who must pay Stamp Duty charges, the current thresholds and costs, and whether you would have to pay Stamp Duty on a new home at Brabazon.

What Are The Stamp Duty Rates in 2024?

What is Stamp Duty?

Stamp Duty Land Tax (SDLT) - often just referred to as Stamp Duty - is a tax charged by the UK Government on the purchase of any land or property over a certain price in England and Northern Ireland.

It is calculated against the purchase price of the property, so how much you will have to pay in Stamp Duty will depend on the price of the home you are buying.

Who Must Pay Stamp Duty?

While Stamp Duty must be paid on all freehold and leasehold properties - new or old, house or apartment - not everyone will have to pay stamp duty. Whether you need to pay or not depends on the purchase price of the property and your personal financial position. It does not apply to property in Scotland or Wales.

More details on Stamp Duty relief and exemptions can be found on the GOV.UK website.

What Is The Stamp Duty Threshold for Homes in England?

The ‘threshold’ is the purchase price at which Stamp Duty Land Tax is applied to your property purchase. If you buy a property below the minimum threshold, then there is no Stamp Duty to pay.

With the Government announcing increases to the Stamp Duty thresholds in September 2022, homebuyers could now save thousands on a new home purchased in 2024.

First-time buyers will now pay no Stamp Duty on the first £425,000 of the property price. That means first-time buyers could now purchase a new house or apartment at Brabazon without paying any Stamp Duty at all!

For existing homeowners or onward buyers, the chargeable threshold has also gone up. Now, you will currently pay no Stamp Duty on the first £250,000 of the property price, which is double the previous tax-free threshold of £125,000.

That means an existing homeowner purchasing a new home at Brabazon, would typically save £2,500 when compared to the rates in place for residential properties between 1st October 2021 and 22nd September 2022.

What Are The Current Stamp Duty Charges in England?

Explore the current Stamp Duty charges for each buying position below:

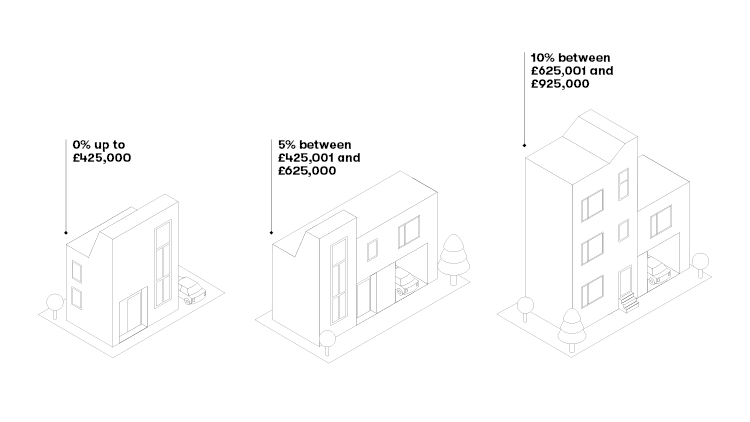

Stamp Duty Rates for First Time Buyers

As a first-time buyer, you will pay no Stamp Duty on the first £425,000 of the property price.

A rate of 5% of the purchase price may be applied when buying a house costing between £425,001 and £625,000. If the purchase price exceeds £625,001, then the standard stamp duty rate of 10% will apply to that portion of the purchase price.

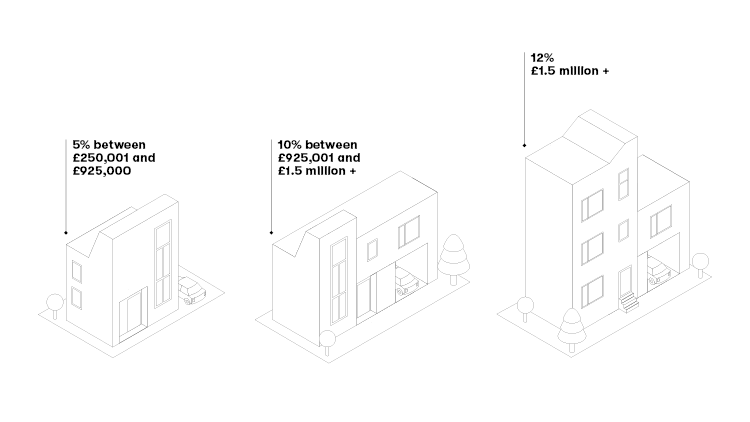

Stamp Duty Rates for Existing Homeowners

As a current homeowner, or someone who has previously owned their own home in the UK, there is no Stamp Duty Land Tax payable on the first £250,000 of the purchase price.

A rate of 5% will apply to homes purchased at a price between £250,001 and £925,000. Rates increase to 10% and then 12% as property price increases above £925,001 and then £1.5 million.

You may also have to pay a higher tax rate if you get the keys to your new home before selling your current one. If this is the case, you may be able to apply for a refund on the government website once your home has been sold.

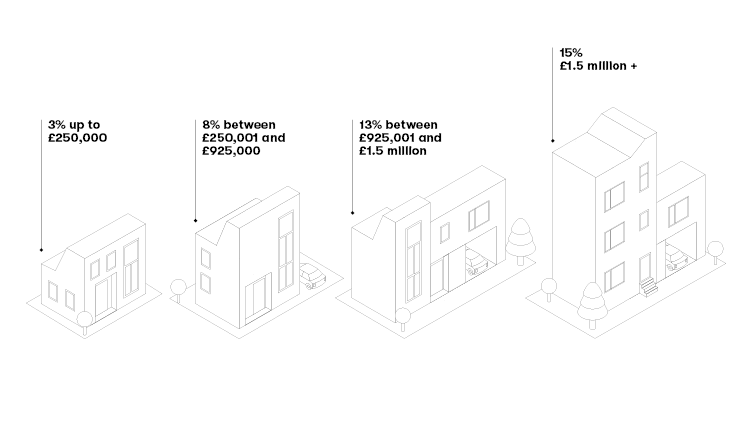

Stamp Duty Rates for Property Investors and Additional Dwellings

If you are buying an investment property or an additional home, such as a buy-to-let apartment, a second dwelling, or a holiday home worth more than £40,000, you will typically pay an additional 3% surcharge on top of the standard rates applicable to existing homeowners.

That means you may now pay 3% on homes purchased up to the value of £250,000; 8% on a purchase price between £250,001 and £925,000; and 13% for ‘higher value’ homes priced between £925,001 and £1.5m. Above £1.5m, Stamp Duty will be charged at a rate of 15% of the purchase price.

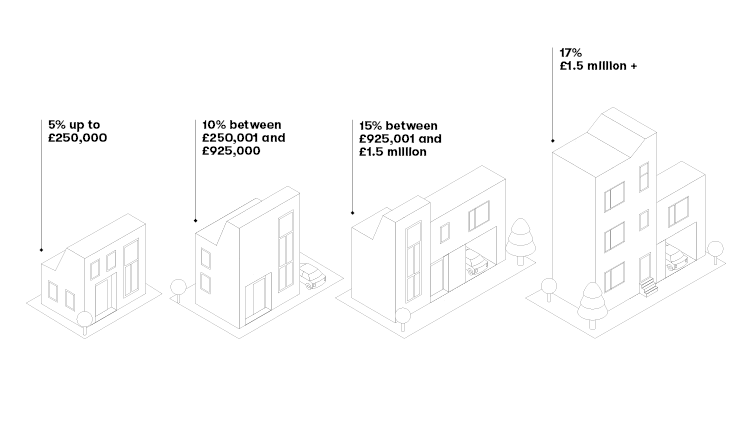

Stamp Duty Rates for Non-UK Residents

From 1st April 2021, an additional 2% Stamp Duty surcharge was introduced for overseas buyers on the purchase of residential property in England and Northern Ireland.

The surcharge is likely to apply to all non-resident buyers, regardless of their buying position, and is charged in addition to the existing 3% Stamp Duty surcharge on purchases of additional dwellings, such as buy-to-lets and second homes.

That means that an overseas buyer may need to pay 5% Stamp Duty on homes purchased up to the value of £250,000; 10% on a property purchase between £250,001 and £925,000; and 15% or 17% on homes priced at £925,001 or £1.5m, respectively.

You can use a Stamp Duty calculator to calculate how much Stamp Duty you may need to pay on the purchase of a new home.

When Must Stamp Duty Be Paid?

You will have 14 days from the day you get the keys to your new house to pay your Stamp Duty charges. Your solicitor will handle the payment to HMRC.

Further information about Stamp Duty in line with the September 2022 revisions can be found online at GOV.UK. The thresholds listed here apply until 31st March 2025.

Need to speak to a Financial Advisor about Stamp Duty as part of your new home purchase? Contact our New Homes Consultants who can put you in touch with our recommended independent financial advisors at Fairstone.