Stamp Duty rates are changing from 1st April 2025. The changes mean some people could pay more when moving home! Act now and move before 31st March 2025 to ensure you benefit from lower Stamp Duty rates. Explore available homes at Brabazon.

What Are The Stamp Duty Rates in 2024?

What is Stamp Duty?

Stamp Duty Land Tax (SDLT) - often just referred to as Stamp Duty - is a tax charged by the UK Government on the purchase of any land or property over a certain price in England and Northern Ireland.

It is calculated against the purchase price of the property, so how much you will have to pay in Stamp Duty will depend on the price of the home you are buying.

Who Must Pay Stamp Duty?

While Stamp Duty must be paid on all freehold and leasehold properties - new or old, house or apartment - not everyone will have to pay stamp duty. Whether you need to pay or not depends on the purchase price of the property and your personal financial position.

More details on Stamp Duty relief and exemptions can be found on the GOV.UK website.

What Is The Stamp Duty Threshold for Homes in England?

Stamp Duty Land Tax is structured into multiple ‘thresholds’ meaning that different portions of the property price are taxed at different rates.

These increase progressively and buyers will pay a different rate per threshold depending on whether they are a first-time buyer, an existing homeowner, an investor or second property purchase, or an overseas buyer.

What Are The Current Stamp Duty Charges in England?

Explore the current Stamp Duty charges for each buying position when purchasing a property in the UK:

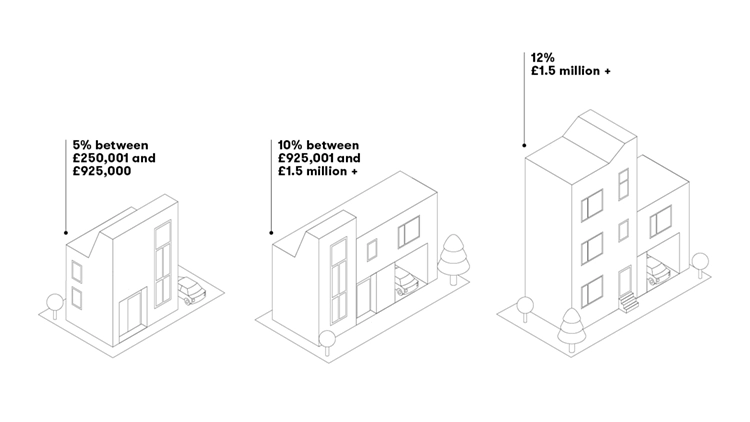

Stamp Duty Rates for Existing Homeowners

As a current homeowner, or someone who has previously owned their own home in the UK, there is no Stamp Duty Land Tax to pay on the first £250,000 of the purchase price, if, after buying the property, it is the only residential property that you own.

A rate of 5% will then apply to the portion of the purchase price between £250,001 and £925,000; 10% on the portion between £925,001 to £1.5million; and 12% on the remaining balance above £1.5million.

If you get the keys to your new home before selling your current one, you will need to pay an additional 3% on top of the above rates. If this is the case, you may be able to apply for a refund on the government website once your home has been sold, providing it is within 36 months.

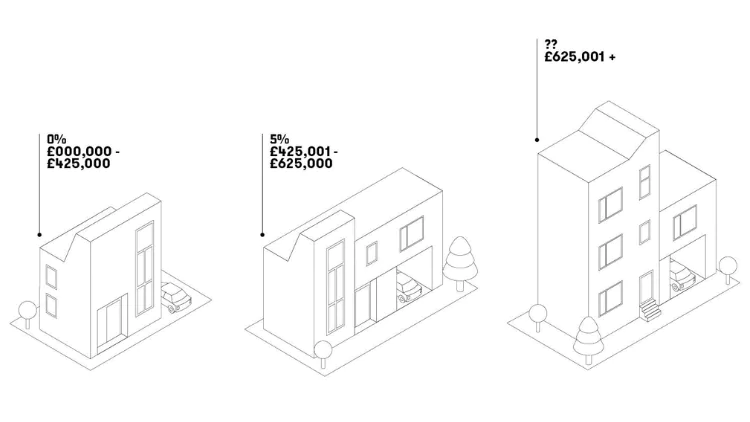

Stamp Duty Rates for First-Time Buyers

First-time buyers can claim a discount (relief) on Stamp Duty rates to help them with the costs associated with buying their first property.

If you, or anyone else you’re buying with, has never owned a property before, you will pay no Stamp Duty at all on the first £425,000 of the property price.

A rate of 5% will then be applied to the portion of the purchase price between £425,001 and £625,000. If the purchase price exceeds £625,001, then standard Stamp Duty rates will apply on the remaining amount, as outlined for existing homeowners above.

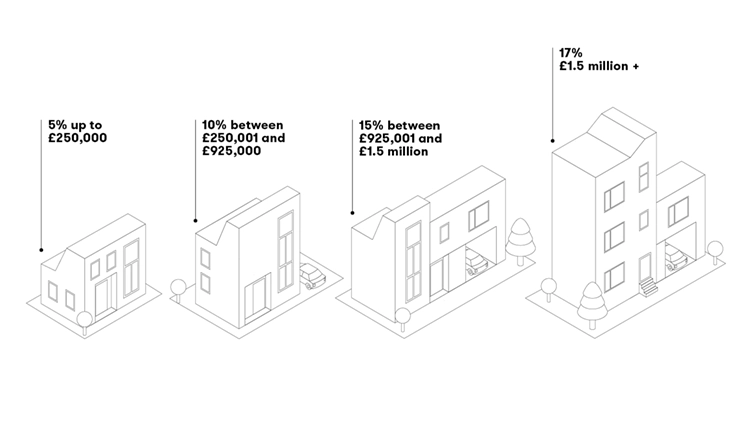

Stamp Duty Rates for Property Investors and Additional Dwellings

If you are buying an investment property or an additional home, such as a buy-to-let property, a second dwelling, or a holiday home worth more than £40,000, you will pay an additional 5% surcharge on top of the standard Stamp Duty rates that apply to existing homeowners.

That means you will now pay 5% on homes purchased up to the value of £250,000; 10% on the portion of the purchase price between £250,001 and £925,000; and 15% on the portion between £925,001 and £1.5million. Above £1.5million, Stamp Duty will be charged at a rate of 17% of the purchase price.

Stamp Duty Rates for Non-UK Residents

You are likely to be classed as a non-UK resident or overseas buyer if you are not present in the UK for at least 183 days or six months during the 12 months before your property purchase.

You may need to pay a 2% Stamp Duty surcharge, in addition to any other rates that may apply to you, such as first-time buyer or additional property rates as outlined above.

That means that an overseas buyer who has already owned a property may need to pay 2% Stamp Duty on homes purchased up to the value of £250,000; 7% on the portion of the purchase price between £205,001 and £925,000; 12% on the portion between £925,001 and £1.5million; and 14% on the remaining balance above £1.5million.

There are exceptions and special rates for buyers in other buying positions, or for those buying a leasehold property. You can use a Stamp Duty calculator to calculate how much Stamp Duty you may need to pay on the purchase of a new home.

When Must Stamp Duty Be Paid?

You will have 14 days from the day you get the keys to your new house to pay your Stamp Duty charges. Your solicitor will handle the payment to HMRC.

Further information about Stamp Duty in line with the September 2022 revisions can be found online at GOV.UK. The thresholds listed here apply until 31st March 2025.

Need to speak to a Financial Advisor about Stamp Duty as part of your new home purchase at Brabazon? Contact our New Homes Consultants who can put you in touch with our recommended independent financial advisors.